Loan Prediction using Machine Learning

Project Statement

The idea behind this project is to build a model that will classify how much loan the user can take. It is based on the user’s marital status, education, number of dependents, and employments.

Approach

I have used K-Nearest Neighbors (KNN) to predict the loan status of the applicant and linear model to estimate how much the user can given the user’s details.

Algorithm used

K-Nearest Neighbors (KNN) Algorithm

K-Nearest Neighbors (KNN) is one of the simplest algorithms used in Machine Learning for regression and classification problem. KNN algorithms use data and classify new data points based on similarity measures (e.g. distance function). Classification is done by a majority vote to its neighbors. The data is assigned to the class which has the nearest neighbors. As you increase the number of nearest neighbors, the value of k, accuracy might increase.

Source to avail the dataset:- Loan prediction dataset

Now, let us understand the implementation of K-Nearest Neighbors (KNN) in Python

Import the Libraries

We will start by importing the necessary libraries required to implement the KNN Algorithm in Python. We will import the numpy libraries for scientific calculation. Next, we will import the matplotlib.pyplot library for plotting the graph. We will import two machine learning libraries KNeighborsClassifier from sklearn.neighbors to implement the k-nearest neighbors vote and accuracyscore from sklearn.metrics for accuracy classification score.Seaborn is a Python data visualization library based on matplotlib. It provides a high-level interface for drawing attractive and informative statistical graphics.pandas is a Python package providing fast, flexible, and expressive data structures.

import pandas as pd

import numpy as np

import matplotlib.pyplot as plt

import seaborn as sns

%matplotlib inline

Read the data

df=pd.read_csv("loan_train.csv")

df.head()

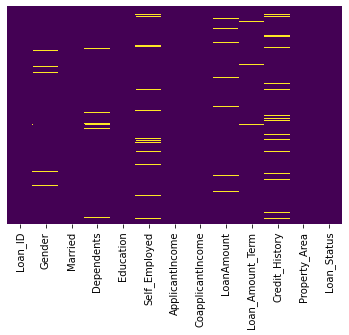

#Heat map showing values which are not available or null

sns.heatmap(df.isnull(),yticklabels=False,cbar=False,cmap='viridis')

We have to eliminate these null values

#The get_dummies() function is used to convert categorical variable into dummy/indicator variables (0’s and 1’s).

sex = pd.get_dummies(df['Gender'],drop_first=True)

married = pd.get_dummies(df['Married'],drop_first=True)

education = pd.get_dummies(df['Education'],drop_first=True)

self_emp = pd.get_dummies(df['Self_Employed'],drop_first=True)

loanStatus = pd.get_dummies(df['Loan_Status'],drop_first=True)

PropArea = pd.get_dummies(df['Property_Area'],drop_first=True)

df.drop(['Gender','Loan_ID','Self_Employed','Married','Education','Loan_Status','Property_Area'],axis=1,inplace=True)

df = pd.concat([df,married,education,sex,self_emp,loanStatus,PropArea],axis=1)

df.head()

#Rename the columns after data manipulation.

df=df.rename(columns={'Yes':'Married','Male':'Gender','Yes':'Self_Employed'})

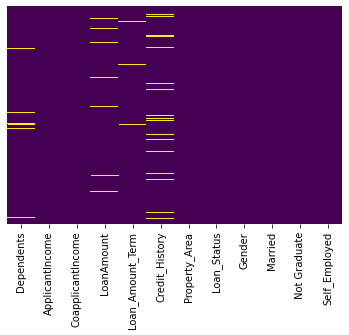

#Heat map after introducing dummy variables.

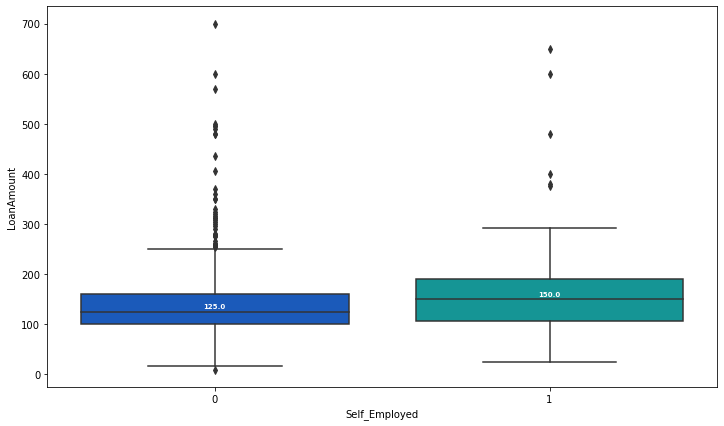

We can see that the attribute LoanAmount contains null values. We identify that the Loan Amount is related to whether the user is self employed. This is represented by the following Box-Plot

We write the impute_LoanAmount function to replace the null Loan Amount values with the values calculated by the function

def impute_LoanAmt(cols):

Loan = cols[0]

selfemp = cols[1]

if pd.isnull(Loan):

if selfemp == 1:

return 150

else:

return 125

else:

return Loan

#Apply the impute_LoanAmt function on the dataset

df['LoanAmount'] = df[['LoanAmount','Self_Employed']].apply(impute_LoanAmt,axis=1)

sns.heatmap(df.isnull(),yticklabels=False,cbar=False,cmap='viridis')

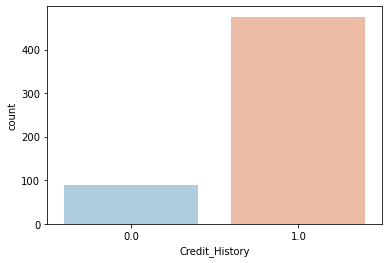

From the below count plot we can see that most of the credit history values are 1.0. So we can replace the null values by 1.0.

sns.countplot(x='Credit_History',data=df,palette='RdBu_r')

df['Credit_History'].fillna(1.0,inplace=True)

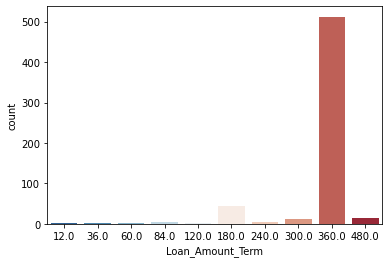

From the below count plot we can see that most of the Loan amount term values are 360. So we can replace the null values by 360.

sns.countplot(x='Loan_Amount_Term',data=df,palette='RdBu_r')

df['Loan_Amount_Term'].fillna(360,inplace=True)

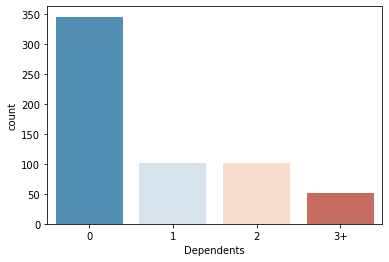

From the below count plot we can see that most of the ‘Dependents’ values are 0. So we can replace the null values by 0.

sns.countplot(x='Dependents',data=df,palette='RdBu_r')

df['Dependents'].fillna(360,inplace=True)

Heatmap aftet eliminating all the null values

sns.heatmap(df.isnull(),yticklabels=False,cbar=False,cmap='viridis')

StandardScaler will transform your data such that its distribution will have a mean value 0 and standard deviation of 1.Assume that all features are centered around 0 and have variance in the same order. If a feature has a variance that is orders of magnitude larger that others, it might dominate the objective function and make the estimator unable to learn from other features correctly as expected.

from sklearn.preprocessing import StandardScaler

scaler = StandardScaler()

train=pd.DataFrame(df.drop('Loan_Status',axis=1))

scaler.fit(train)

scaled_features = scaler.transform(train)

df_feat = pd.DataFrame(scaled_features,columns=train.columns)

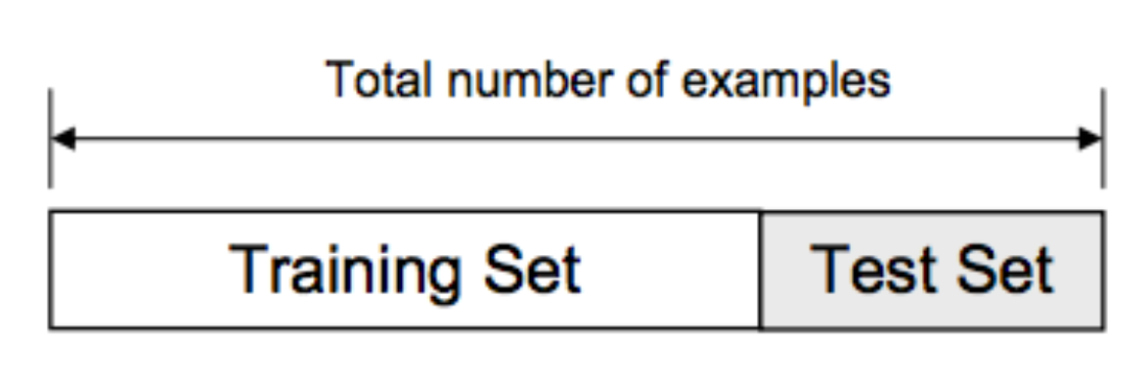

Train/Test Split

The data we use is usually split into training data and test data. The training set contains a known output and the model learns on this data in order to be generalized to other data later on. We have the test dataset (or subset) in order to test our model’s prediction on this subset.

#Here we split the dataset 70/30….70% training dataset, 30% testing dataset.

#Here we split the dataset 70/30….70% training dataset, 30% testing dataset.

from sklearn.model_selection import train_test_split

X_train, X_test, y_train, y_test = train_test_split(scaled_features,df['Loan_Status'],test_size=0.30)

Now let predict the loan status using KNN algorithm.

from sklearn.neighbors import KNeighborsClassifier

#Let fit training dataset into the model. Let the initial value of k be 3.

knn = KNeighborsClassifier(n_neighbors=3)

knn.fit(X_train,y_train)

_#Predict the values using test dataset.

pred = knn.predict(X_test)

#Print the classification reprot and confusion matrix

from sklearn.metrics import classification_report,confusion_matrix

print(confusion_matrix(y_test,pred))

print(classification_report(y_test,pred))

Confusion matrix

[[ 30 34] [ 14 107]]

Classification report

precision recall f1-score support

0 0.68 0.47 0.56 64

1 0.76 0.88 0.82 121

accuracy 0.74 185

macro avg 0.72 0.68 0.69 185

weighted avg 0.73 0.74 0.73 185

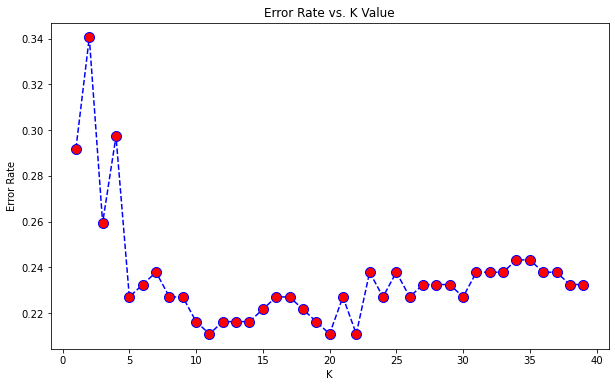

To find a optimum value of k we plot a graph of error rate vs k value ranging from 0 to 40.

error_rate = []

for i in range(1,40):

knn = KNeighborsClassifier(n_neighbors=i)

knn.fit(X_train,y_train)

pred_i = knn.predict(X_test)

error_rate.append(np.mean(pred_i != y_test))

plt.figure(figsize=(10,6))

plt.plot(range(1,40),error_rate,color='blue', linestyle='dashed', marker='o',

markerfacecolor='red', markersize=10)

plt.title('Error Rate vs. K Value')

plt.xlabel('K')

plt.ylabel('Error Rate')

So from the graph wecan deduce that k=10 has least error rate. Hence we re_apply the algorithm for k=10.

knn = KNeighborsClassifier(n_neighbors=10)

knn.fit(X_train,y_train)

Print the accuracy score

from sklearn.metrics import accuracy_score

print(accuracy_score(y_test,pred))

We can see that the accuracy score has increased from 0.74 to 0.79.

Linear regression

Linear regression is probably one of the most important and widely used regression techniques. It’s among the simplest regression methods. One of its main advantages is the ease of interpreting results.

Problem formulation

When implementing linear regression of some dependent variable 𝑦 on the set of independent variables 𝐱 = (𝑥₁, …, 𝑥ᵣ), where 𝑟 is the number of predictors, you assume a linear relationship between 𝑦 and 𝐱: 𝑦 = 𝛽₀ + 𝛽₁𝑥₁ + ⋯ + 𝛽ᵣ𝑥ᵣ + 𝜀. This equation is the regression equation. 𝛽₀, 𝛽₁, …, 𝛽ᵣ are the regression coefficients, and 𝜀 is the random error.

Linear regression calculates the estimators of the regression coefficients or simply the predicted weights, denoted with 𝑏₀, 𝑏₁, …, 𝑏ᵣ. They define the estimated regression function 𝑓(𝐱) = 𝑏₀ + 𝑏₁𝑥₁ + ⋯ + 𝑏ᵣ𝑥ᵣ. This function should capture the dependencies between the inputs and output sufficiently well.

The estimated or predicted response, 𝑓(𝐱ᵢ), for each observation 𝑖 = 1, …, 𝑛, should be as close as possible to the corresponding actual response 𝑦ᵢ. The differences 𝑦ᵢ - 𝑓(𝐱ᵢ) for all observations 𝑖 = 1, …, 𝑛, are called the residuals. Regression is about determining the best predicted weights, that is the weights corresponding to the smallest residuals.

Now we use linear regression to predict the loan amount based on user’s details.

_#Assign the train and test datasets.

x=df[['Married', 'Not Graduate', 'Dependents',

'Self_Employed','ApplicantIncome','CoapplicantIncome','Semiurban','Urban','Loan_Amount_Term']]

y=df['LoanAmount']

X_train,X_test,Y_train,Y_test=train_test_split(x,y,test_size=0.3,random_state=101)

from sklearn.linear_model import LinearRegression

#Train the model to predict the values.

lm=LinearRegression()

lm.fit(X_train,Y_train)

Now we find the intercept

print(lm.intercept_)

53.85642282094781

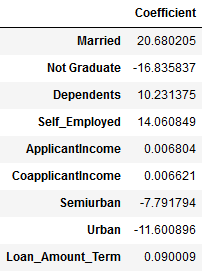

Now we print the values of coefficients. These coefficients can be used to find the value of loan amount that the user can take given the user’s details

coeff=pd.DataFrame(lm.coef_,x.columns,columns=['Coefficient'])

coeff

Now let us predict the loan amount for a random set of values.

lm.predict([[1,0,3,1,4000,3000,0,1,360]])

187.17168163

Bayesian Ridge regression

Bayesian regression allows a natural mechanism to survive insufficient data or poorly distributed data by formulating linear regression using probability distributors rather than point estimates. The output or response ‘y’ is assumed to drawn from a probability distribution rather than estimated as a single value.

from sklearn import linear_model

bm=linear_model.BayesianRidge()

bm.fit(X_train,Y_train)

BayesianRidge(alpha_1=1e-06, alpha_2=1e-06, alpha_init=None,

compute_score=False, copy_X=True, fit_intercept=True,

lambda_1=1e-06, lambda_2=1e-06, lambda_init=None, n_iter=300,

normalize=False, tol=0.001, verbose=False)

Now let us predict the loan amount for a random set of values.

bm.predict([[1,0,3,1,4000,3000,0,1,360,1.0]])

143.98938586

XGB regression

Regression predictive modeling problems involve predicting a numerical value such as a dollar amount or a height. XGBoost can be used directly for regression predictive modeling.

from xgboost import XGBRegressor

model=XGBRegressor()

model.fit(X_train,Y_train)

XGBRegressor(base_score=0.5, booster='gbtree', colsample_bylevel=1,

colsample_bynode=1, colsample_bytree=1, gamma=0,

importance_type='gain', learning_rate=0.1, max_delta_step=0,

max_depth=3, min_child_weight=1, missing=None, n_estimators=100,

n_jobs=1, nthread=None, objective='reg:linear', random_state=0,

reg_alpha=0, reg_lambda=1, scale_pos_weight=1, seed=None,

silent=None, subsample=1, verbosity=1)

Now let us predict the loan amount for a random set of values.

yhat = model.predict([[1,0,3,1,4000,3000,0,1,360,1.0]])

155.877

Random forest regressor

A random forest is a meta estimator that fits a number of classifying decision trees on various sub-samples of the dataset and uses averaging to improve the predictive accuracy and control over-fitting. The sub-sample size is controlled with the max_samples parameter if bootstrap=True (default), otherwise the whole dataset is used to build each tree.

from sklearn.ensemble import RandomForestRegressor

regr = RandomForestRegressor(max_depth=2, random_state=0)

regr.fit(X_train,Y_train)

RandomForestRegressor(bootstrap=True, ccp_alpha=0.0, criterion='mse',

max_depth=2, max_features='auto', max_leaf_nodes=None,

max_samples=None, min_impurity_decrease=0.0,

min_impurity_split=None, min_samples_leaf=1,

min_samples_split=2, min_weight_fraction_leaf=0.0,

n_estimators=100, n_jobs=None, oob_score=False,

random_state=0, verbose=0, warm_start=False)

Now let us predict the loan amount for a random set of values.

regr.predict([[1,0,3,1,4000,3000,0,1,360,1.0]])

123.46250175

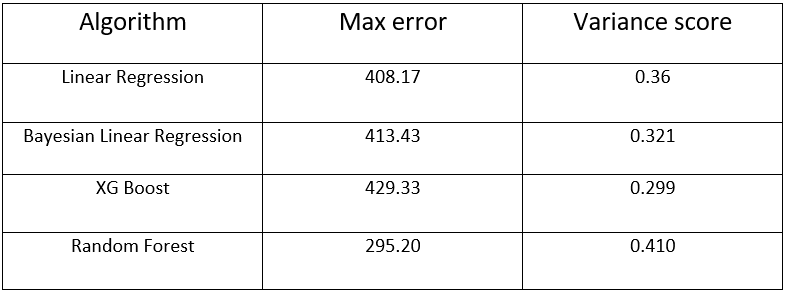

Model performance comparision

Max_error

The max_error function computes the maximum residual error , a metric that captures the worst case error between the predicted value and the true value. In a perfectly fitted single output regression model, max_error would be 0 on the training set and though this would be highly unlikely in the real world, this metric shows the extent of error that the model had when it was fitted.

Variance score

The explained variance score explains the dispersion of errors of a given dataset. Scores close to 1.0 are highly desired, indicating better squares of standard deviations of errors.